“Instant withdrawals” is one of the most overused phrases in online payments. In 2025, plenty of services can pay out quickly, but “instant” often means “instant on their side,” while your money still takes time to reach you. The difference comes down to payment rails, compliance checks, banking cut-off times, and the fine print around limits.

This guide breaks down the most common payout methods people use today: e-wallets, crypto, instant bank transfers, and prepaid cards and explains what actually happens between clicking “Withdraw” and seeing spendable money.

What “Instant” Really Means (and Why It’s Confusing)

When a platform advertises instant payouts, it might mean one of these:

- Instant approval: Your withdrawal request is approved immediately, but the payment network still takes time.

- Instant initiation: The platform sends the payment right away, but the receiving method batches or delays settlement.

- Instant availability: Funds become spendable immediately in your wallet/account. This is the true “instant,” and it’s rarer.

Also, even fast methods can be slowed down by:

- KYC/AML checks (identity verification, source-of-funds review)

- Fraud/risk scoring (especially for first-time withdrawals or unusual amounts)

- Name mismatch (account name doesn’t match the platform’s verified identity)

- Currency conversion (extra steps, extra checks)

- Banking windows (weekends, holidays, cut-off times)

- Network congestion (mostly relevant for crypto)

If you want reliably fast payouts, you’re choosing the path with the fewest middlemen and the most automation.

To understand why some casinos pay out in minutes while others still take days—even when using the same payment methods – this guide on fast payout casinos breaks down the real operational and compliance factors behind withdrawal speed.

1) E-Wallets: Often the Fastest “Normal” Option

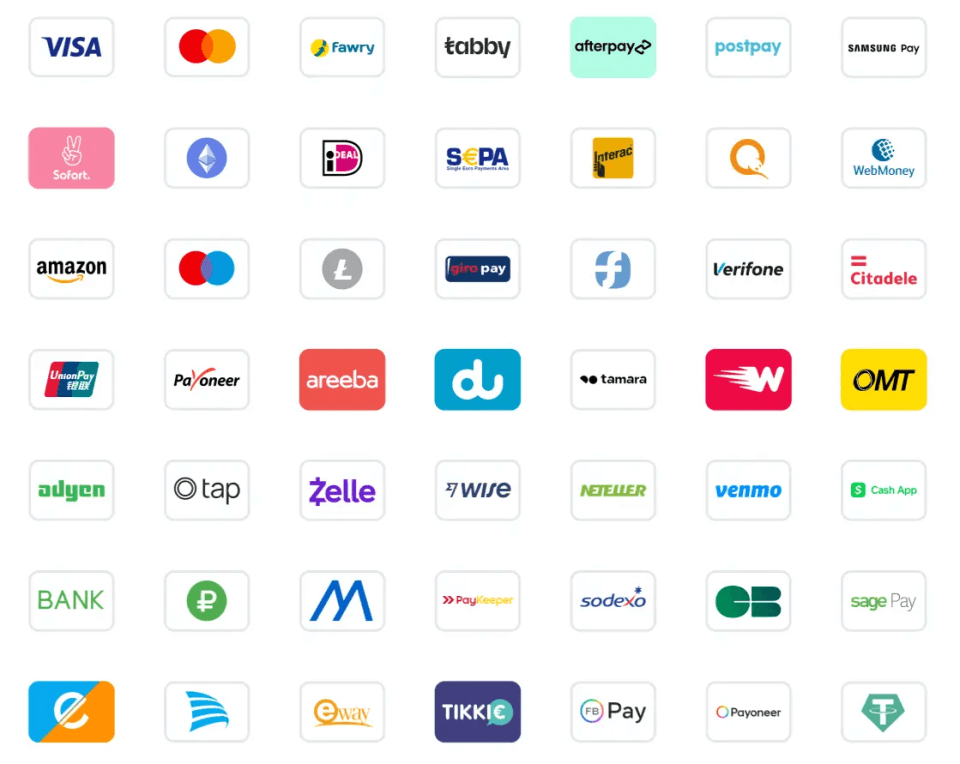

Examples: PayPal (where supported), Skrill, Neteller, ecoPayz, local wallets depending on region.

Real processing times

- Best case: Minutes to a few hours

- Common case: Same day

- Slow case: 24–48 hours (risk reviews, first-time withdrawals, manual checks)

E-wallets are fast because they’re designed to move money internally without relying on bank settlement windows. Many platforms also prioritize e-wallet withdrawals because they have fewer failure points than bank transfers.

What marketing claims usually mean

When you see “instant withdrawals to e-wallets,” it often means:

- The site approves the withdrawal quickly, and

- The e-wallet receives it quickly once sent.

But if the platform performs manual review, the clock doesn’t start until approval.

Common limits and constraints

- Minimum withdrawal: Often low (e.g., $10–$20 equivalent)

- Maximum per transaction/day: Varies widely; verified users get higher caps

- Fees: Sometimes free from the platform, but the wallet may charge to move money to your bank

- Account verification: Many wallets restrict withdrawals until ID checks are done

How to avoid delays

- Verify your e-wallet account early (ID + address where required).

- Use the same email/identity name on both sides.

- Withdraw in a consistent pattern (sudden large jumps can trigger review).

- Avoid requesting withdrawals during peak support hours if the platform does manual approvals.

Verdict: If available in your region, e-wallets are one of the most consistently fast options.

2) Crypto: Can Be Fast, But “Instant” Depends on the Chain

Crypto withdrawals can be very quick, but they’re also the most misunderstood. Speed depends on three things:

- Platform approval time

- Blockchain confirmation time

- Exchange/wallet crediting rules (if you’re sending to an exchange)

Real processing times

- Best case: 5-15 minutes

- Common case: 10-60 minutes

- Slow case: Several hours (network congestion, low fees, platform batching, extra compliance checks)

In 2025, many platforms still batch transactions (sending multiple withdrawals together) to save fees. That can add delay even when the blockchain itself is fast.

Which crypto options tend to be fastest

- Stablecoins on efficient networks are often the practical choice for speed + value stability.

- Lightning Network (Bitcoin) can be extremely fast when supported end-to-end, but support varies.

- Some networks confirm quickly but may require many confirmations at exchanges, which slows “availability.”

Common limits and constraints

- Minimum withdrawal: Usually set to avoid dust/fee inefficiency

- Maximum: Often high, but may trigger extra source-of-funds checks

- Fees: Network fees + potential platform fee

- Address risk screening: Some platforms delay or block payouts to flagged addresses

How to avoid delays (and costly mistakes)

- Always double-check the network (e.g., sending a token on the wrong chain is a classic disaster).

- If you need speed, choose a network known for consistent throughput and low congestion.

- If withdrawing to an exchange, remember the exchange may require extra confirmations (which adds time even if the chain is quick).

- Consider withdrawing to a personal wallet first if your exchange is slow to credit.

Verdict: Crypto can be among the fastest, but it’s the most variable. Great for experienced users, less forgiving for beginners.

3) Instant Bank Transfers: Fast When the Rails Support It

This category includes modern bank transfer systems designed for near real-time settlement.

Examples (by type):

- Instant payment schemes (varies by country/region)

- Faster Payments / real-time bank rails

- Push-to-bank options offered through payment processors

Real processing times

- Best case: Seconds to minutes

- Common case: Minutes to a few hours

- Slow case: Same day or next business day (bank maintenance windows, compliance holds, weekends depending on the rail)

When instant bank rails are supported, they’re excellent: money goes directly to your bank, often with minimal friction.

Why “instant bank transfer” sometimes isn’t instant

Some platforms label regular bank transfers as “instant” because they process them quickly internally. But traditional transfers can still take 1-3 business days, especially cross-border.

Also, banks occasionally:

- hold incoming transfers for review,

- reject transfers if details don’t match,

- delay processing during maintenance windows.

Common limits and constraints

- Per-transfer caps (often imposed by bank rail rules or the platform’s risk policy)

- Daily/weekly limits tied to verification level

- Name match requirements are usually strict

- Higher failure rate than wallets if account details are wrong

How to avoid delays

- Use a bank account with instant-payment support where available.

- Ensure your legal name and bank account name match exactly.

- Avoid withdrawing right before weekends/holidays if you’re unsure the rail is true real-time.

- Keep a record of successful payout amounts to stay within normal patterns.

Verdict: Potentially the best mix of speed and convenience – if your region and bank support true instant rails.

4) Prepaid Cards: Fast Access, But Not Always a “Withdrawal”

Prepaid cards (including virtual cards) are often marketed as instant because you can spend quickly once funds are loaded. But there are two distinct models:

- Card-linked payout (push-to-card / card load): funds are added to the card balance

- Withdrawal to card as a transfer: money “withdraws” through a network process that behaves more like a bank/card transaction

Real processing times

- Best case: Minutes

- Common case: Same day

- Slow case: 1-2 business days (especially if the payout is actually routed like a standard transfer)

Prepaid cards can be great if your goal is fast spending, not necessarily fast cash-out to a bank.

Common limits and constraints

- Lower limits than bank transfers for many users

- ATM withdrawal limits can be restrictive

- Fees: ATM fees, card load fees, FX fees, inactivity fees (depends on issuer)

- Card verification and region restrictions are common

How to avoid delays

- Understand whether you’re getting a card load (usually faster) or a transfer to card (may be slower).

- Check fee schedules-fast access isn’t helpful if fees eat your payout.

- Confirm the card supports your country/currency to avoid compliance holds.

Verdict: Often fast for spending, sometimes less ideal for moving money into your bank account.

Real-World Speed Ranking (Typical Experience)

While exact results depend on the platform and your country, a practical “most likely to feel instant” ranking looks like:

- E-wallets (very consistent if verified)

- Instant bank rails (excellent where truly supported; varies by region/bank)

- Crypto (can be very fast, but variable and more error-prone)

- Prepaid cards (fast access for spending, but terms/fees/limits matter)

The key is consistency: the “fastest once” method isn’t as useful as the method that’s fast every time.

Common Withdrawal Limits You’ll See in 2025

Even when payouts are quick, limits shape your experience:

- Minimum withdrawals: to reduce processing costs and prevent abuse

- Tiered maximums: higher limits require higher verification levels

- Daily/weekly caps: part of risk control and regulatory compliance

- Method-specific caps: e-wallets and cards often have different ceilings than bank rails

- First-withdrawal limits: some services intentionally slow or cap early withdrawals until trust is established

If you’re hitting delays, it’s often because your withdrawal bumped into a limit that triggers manual review.

How Players Can Avoid Delays (Checklist)

If you want payouts that are genuinely fast, do the boring stuff early:

- Complete KYC before you need it. Upload ID and proof of address in advance.

- Use one identity everywhere. Same name, same email/phone, consistent details.

- Withdraw using the same method you used to deposit when possible. Many platforms enforce this.

- Avoid last-minute changes (new device, new IP country, new payment method) right before withdrawing.

- Keep withdrawals “normal.” Consistent amounts and cadence reduce risk flags.

- Check fees and net amount. Some “instant” methods charge enough to make them unattractive.

- Know the platform’s cut-off times (especially for bank-related methods).

- Start with a small test withdrawal on a new method to confirm it works smoothly.

Bottom Line

In 2025, instant withdrawals are real, but only when the entire chain is built for speed. E-wallets and true instant bank transfers are the most reliable options for most users. Crypto can be extremely fast, but it’s less predictable and easier to mess up. Prepaid cards are often great for quick spending, but the limits and fees can quietly undermine the “instant” promise.

If you want to consistently get paid fast, focus less on the marketing label and more on the three things that actually matter: verification status, payment rail type, and method-specific limits. Once those are aligned, “instant” starts to feel like it should.

Sources: